Biocon Q3FY26 Operating Revenue at Rs 4,173 Cr; Q3FY26 EBITDA at Rs 951 Cr; Q3FY26 Net Profit at Rs 144 Cr

- Thu, 12-Feb-2026

- Posted by: Biocon Biologics

Bengaluru, Karnataka, India: February 12, 2026:

Biocon Limited (BSE code: 532523, NSE: BIOCON), an innovation-led global biopharmaceuticals company, today announced its consolidated financial results for the fiscal third quarter ended December 31, 2025.

Leadership Comments

BIOCON GROUP

“This quarter marks the culmination of several strategic steps that have created a stronger and simpler group structure for Biocon Limited. The ~USD 1 billion raised cumulatively through two QIPs within a span of eight months demonstrates robust and sustained investor confidence in our overall business growth and direction. The settlement of structured debt obligations earlier this year significantly strengthened our balance sheet, with an improvement in the consolidated debt-to-EBITDA ratio. This will improve PBT margins going forward with the full impact of reduced interest costs of ~INR 300 crore annually expected to be reflected in FY27. These factors are reflected in S&P’s upgrade of our Biosimilars business to BB+ with a ‘Stable’ outlook and Fitch revising its outlook to ‘Positive’. Finally, the integration of Biocon Biologics Limited as a wholly owned subsidiary of Biocon Limited will bring to life our unified One Biocon vision.”

– Kiran Mazumdar-Shaw, Chairperson, Biocon Group

BIOCON GENERICS

“The Generics business continued to see momentum in the third quarter, delivering strong sequential and year-on-year revenue growth of 10% and 24%, respectively. This performance was driven by the ongoing launches of gLiraglutide across EU markets, alongside an improved performance in our generic formulations portfolio, supported by select new product launches and base business growth in the U.S.

Looking ahead, we will focus on expanding gLiraglutide launches to additional approved EU markets, and to the U.S. pending regulatory approval.”

– Siddharth Mittal, CEO & Managing Director, Biocon Limited

BIOCON BIOLOGICS

“Biocon Biologics reported a robust Q3FY26 performance, with EBITDA of ₹700 crore, up over 44% year on year, driven by strong demand and favorable pricing across key markets. North America continued to power growth during the quarter.

We expanded our commercial portfolio with launches of Yesintek (bUstekinumab), Kirsty (bAspart), Jobevne (bBevacizumab), and Yesafili (bAflibercept), and are preparing for the launch of Vevzuo and Bosaya our two bDenosumab products in several markets globally. Inclusion of bTrastuzumab SubQ, bNivolumab, and bPembrolizumab in addition to bPertuzumab, will further strengthen our leadership in oncology and positions us well for sustained growth.”

– Shreehas Tambe, CEO & Managing Director, Biocon Biologics Limited

SYNGENE

“The key variable impacting our third quarter performance has been the ongoing impact related to a single product from one of our large molecule biologics clients. Outside of this factor, our underlying business performance has shown steady progress, with the Research Services business continuing to secure new customers and contracts. The highlight of the quarter was the extension of our relationship with Bristol Myers Squibb through to 2035, providing both partners with a strategic ten-year horizon to further develop and expand this unique, long-standing collaboration.”

– Peter Bains, CEO & Managing Director, Syngene International Limited.

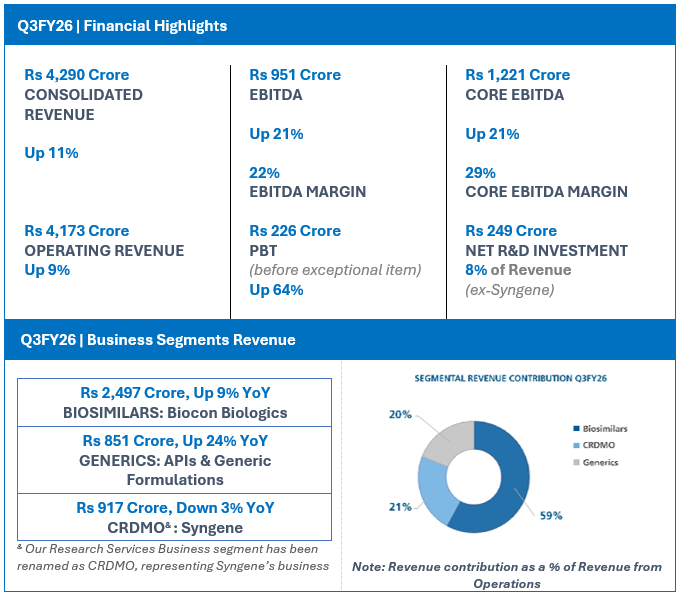

FINANCIAL HIGHLIGHTS (CONSOLIDATED): Q3FY26

In Rs Crore

| Particulars | Q3FY26 | Q3FY25 | YoY (%) |

| INCOME | |||

| Biosimilars | 2,497 | 2,289 | 9 |

| Generics | 851 | 686 | 24 |

| CRDMO/ Research Services | 917 | 944 | (3) |

| Inter-segment | (92) | (98) | |

| Revenue from operations# | 4,173 | 3,821 | 9 |

| Other income | 117 | 35 | 237 |

| Total Revenue | 4,290 | 3,856 | 11 |

| Net R&D Expenses | 249 | 199 | 25 |

| EBITDA | 951 | 787 | 21 |

| EBITDA Margins | 22% | 20% | |

| Core EBITDA$ | 1,221 | 1,007 | 21 |

| Core EBITDA Margins | 29% | 26% | |

| PBT (before Exceptional Items^) | 226 | 138 | 64 |

| Net Profit (before Exceptional Items) | 124 | 13 | 844 |

| Net Profit (Reported) | 144 | 25 | 475 |

Figures above are rounded off to the nearest Crore; % based on absolute numbers.

Notes to financials above:

#Revenue from operations includes licensing income

$Core EBITDA is EBITDA net of R&D expense, licensing, forex, and mark-to-market movement on investments.

^Exceptional items: Q3 FY26: BBL share swap cost, change in labor code, inventory provisioning partially offset by the derivative gain recognized on settlement; Q3FY25: BBL working capital gain and Inventory repurpose offset by acquisition loan closure

Financial Commentary: Q3FY26

Operating Revenue for Q3FY26 grew 9% year-on-year (YoY) to Rs 4,173 crore.

Core EBITDA at Rs 1,221 crore, grew 21% with core operating margins of 29%.

Net R&D investments for the quarter were Rs 249 crore, representing 8% of revenue ex-Syngene.

EBITDA for the quarter at Rs 951 crore, grew by 21% with an EBITDA margin of 22%.

Profit Before Tax before exceptional items is Rs 226 crore, an increase of 64%.

Reported Net Profit for the quarter is Rs 144 crore, up 475%.

Corporate Highlights

Biocon Limited has executed a strategic corporate action to fully integrate Biocon Biologics Limited as a wholly owned subsidiary by acquiring the stakes held by minority shareholders. The transaction valued Biocon Biologics at approximately USD 5.5 billion. This marks a pivotal step in combining the businesses to leverage our global commercial infrastructure, simplifying the corporate structure and strengthening our global position to lead in diabetes, oncology, and immunology through a differentiated portfolio of biosimilars, insulins, generics and peptides (GLP-1s).

In January 2026, Biocon raised Rs 4,150 crore (~USD 460 million) through a successful Qualified Institutions Placement (QIP) and used the proceeds primarily to fund the cash consideration payable to Mylan (Viatris) for buying out its shareholding in Biocon Biologics. The QIP, which saw healthy interest from a diverse set of domestic and global investors, was Biocon’s second equity issuance within eight months. Cumulatively, the Company raised nearly USD 1 billion.

In January, S&P Global Ratings upgraded Biocon Biologics’ long-term issuer credit rating from BB to BB+, with a ‘Stable’ outlook. In February, Fitch Ratings revised the outlook on Biocon Biologics’ Long-Term Foreign-Currency Issuer Default Rating (IDR) from ‘Stable’ to ‘Positive’. These upgrades serve as strong external validation of the progress Biocon has made in strengthening the balance sheet.

Awards and Recognitions

- Kiran Mazumdar-Shaw honored with the prestigious USC Business Management Award, at the inaugural University of Southern California (USC) India Awards.

- Shreehas Tambe, CEO & Managing Director, Biocon Biologics, conferred the ET Edge India’s Impactful CEO Award in the ‘Impactful Unicorn CEO’ category.

- Shreehas Tambe won the BW Pharma World Pharma Leadership Award 2026 in the ‘Visionary Leadership in Pharma’ category.

Sustainability / ESG

- Biocon Limited scored 73 in the 2025 S&P Global Corporate Sustainability Assessment reflecting an improvement of 5 points over the last year.

- Biocon Biologics significantly improved its ESG score to 64 in the 2025 S&P Global Corporate Sustainability Assessment (CSA), up from 53 the previous year.

- Syngene earned its second TIME–Statista honor in six months, featuring in the 2026 ‘World’s Best Companies in Sustainable Growth’ list as a global Top 3 and India’s No. 1 in the Pharma and Biotech category.

Business Highlights

BIOSIMILARS: Biocon Biologics

- Q3FY26 Revenue from Operations at Rs 2,497 crore, up 9% YoY

- 9MFY26 Revenue from Operations at Rs 7,676 crore, up 17% YoY

- Q3FY26 EBITDA is Rs 700 crore; representing EBITDA Margin of 28%

- Q3FY26 R&D Investments accounting for 7% of Revenue

- Served 6.3+ Million Patients (MAT December 2025 basis)##

##12-month moving annual patient population (January 2024 to December 2025)

Business Performance

Biosimilars revenue from operations for Q3FY26 grew 9% year‑on‑year (YoY) to Rs 2,497 crore. EBITDA increased 44% YoY to Rs 700 crore, representing an EBITDA margin of 28%, driven by an improved product and geographic mix as well as operating leverage benefits, as the company continued to realize the benefits of economies of scale.

During the quarter, Biocon Biologics took strategic actions to deepen its portfolio, accelerate market access, and enhance commercial flexibility, supporting long-term growth.

The Company disclosed three new biosimilars assets in its pipeline – Trastuzumab subcutaneous (SC), Nivolumab and Pembrolizumab. These are among the largest oncology biologics scheduled to lose exclusivity over the next five years.

The Company gained global market entry for biosimilar Aflibercept and biosimilar Denosumab through patent settlement agreements. It also secured full and exclusive global rights for biosimilar Adalimumab from Fujifilm Kyowa Kirin Biologics (FKB), assuming end-to-end responsibility for manufacturing and commercialization along with rights for any additional development activities.

Civica launched Insulin Glargine under the CalRx brand in California in January, through its exclusive distributorship arrangement with Biocon Biologics, expanding access to an affordable, high-quality long-acting insulin analog for diabetes patients.

GENERICS: APIs & Generic Formulations

- Q3FY26 Revenue from Operations at Rs 851 Crore, up 24% YoY

- 9MFY26 Revenue from Operations at Rs 2,321 Crore, up 18% YoY

- Q3FY26 R&D Investment at Rs 76 crore, representing 9% of Revenue

Business Performance

During the quarter, the Company launched Liraglutide for diabetes (gVictoza®) and obesity (gSaxenda®) in the Netherlands as its first ‘direct-to-market’ GLP-1 in the EU.

In the U.S., final approval was obtained for Tofacitinib Extended-Release Tablets in 11mg strength, and tentative approval for 22mg strength. Approval was also received for Everolimus tablets for oral suspension in 2mg, 3mg and 5mg strengths.

Regulatory Inspections

The Company received an Establishment Inspection Report (EIR) with a Voluntary Action Indicated (VAI) from the U.S. FDA for the OSD facility in Cranbury, U.S., following an inspection conducted in October 2025.

The Company’s API plant in in Visakhapatnam (Site 6) received an EIR with a VAI from the U.S. FDA following a GMP inspection conducted in November 2025.

CRDMO: Syngene

- Q3FY26 Revenue from Operations at Rs 917 Crore, down 3% YoY

- 9MFY26 Revenue from Operations at Rs 2,702 Crore, up 3% YoY

Business Performance

Syngene extended its strategic research collaboration with Bristol Myers Squibb until 2035 and broadened the scope of integrated services provided to its long-term partner. The Company also strengthened its oral solid dosage platform with the commissioning of a commercial-scale facility for liquid-filled hard gelatin capsules. It expanded its advanced chemistry capabilities at its Hyderabad site to support quicker delivery of high-quality drug substances for its clients.

Note: Biocon in Q1FY26 renamed its Research Services business segment as CRDMO to represent Syngene’s business model of a CRO + CMO.

About Biocon Limited

Biocon Limited, publicly listed in 2004, (BSE code: 532523, NSE Id: BIOCON, ISIN Id: INE376G01013) is an innovation-led global biopharmaceuticals company committed to enhance affordable access to complex therapies for chronic conditions like diabetes, cancer and autoimmune. It has developed and commercialized novel biologics, biosimilars, and complex small molecule APIs in India and several key global markets as well as Generic Formulations in the U.S., Europe & key emerging markets. It also has a pipeline of promising novel assets in immunotherapy under development. Website: www.biocon.com Follow-us on X (formerly Twitter) @bioconlimited and LinkedIn: @BioconLimited for company updates. For FY25 Integrated Annual Report of Biocon click here

Biocon Biologics Limited, a subsidiary of Biocon Limited, is a unique, fully integrated, global biosimilars company committed to transforming healthcare and transforming lives. It is capitalizing on its ‘lab to market’ capabilities to serve over 6.3 million patients across 120+ countries by enabling affordable access to high quality biosimilars. The Company is leveraging cutting-edge science, innovative tech platforms, global scale manufacturing capabilities and world-class quality systems to lower costs of biological therapeutics while improving healthcare outcomes.

Biocon Biologics has commercialized 10 biosimilars from its portfolio which are addressing the patients’ needs in key emerging markets and advanced markets like U.S., Europe, Australia, Canada, and Japan. It has a pipeline of 20+ biosimilar assets across diabetology, oncology, immunology, ophthalmology, bone health and other non-communicable diseases. The Company has many ‘firsts’ to its credit in the biosimilars industry. As part of its environmental, social and governance (ESG) commitment, it is advancing the health of patients, people, and the planet to achieve key UN Sustainable Development Goals (SDGs). Website: www.bioconbiologics.com; Follow us on X (formerly Twitter): @BioconBiologics and LinkedIn: Biocon Biologics for company updates.

About Syngene International Ltd.

Syngene International Ltd. (BSE: 539268, NSE: SYNGENE, ISIN: INE 398R01022) is an integrated research, development, and manufacturing services company serving the global pharmaceutical, biotechnology, nutrition, animal health, consumer goods, and specialty chemical sectors. Syngene’s team of over 5,600 scientists brings both deep expertise and the capacity to deliver scientific excellence, robust data security, and world class manufacturing, at speed, to improve time-to-market and lower the cost of innovation. With 2.5+ mn sq. ft of specialized discovery, development, and manufacturing facilities, Syngene works with around 400 global customers across industry segments, including biotech companies pursuing leading-edge science and multinationals such as BMS, GSK, Zoetis, and Merck KGaA. For more details, visit www.syngeneintl.com . For the Company’s latest Environmental, Social, and Governance (ESG) report, visit Syngene ESG Report.

Brazil

Brazil Egypt

Egypt Europe

Europe Hong Kong

Hong Kong Malaysia

Malaysia Mexico

Mexico Morocco

Morocco Philippines

Philippines Saudi Arabia

Saudi Arabia South Africa

South Africa Taiwan

Taiwan Thailand

Thailand Tunisia

Tunisia Turkey

Turkey UAE

UAE USA

USA Vietnam

Vietnam Canada

Canada Global HQ

Global HQ