Biocon Q2FY26 Operating Revenue at Rs 4,296 Cr, Up 20%

- Tue, 11-Nov-2025

- Posted by: Biocon Biologics

EBITDA at Rs 928 crore; Up 29%;

PBT (before exceptional items) at Rs 183 Cr, Up 153%

Bengaluru, Karnataka, India: November 11, 2025:

Biocon Limited (BSE code: 532523, NSE: BIOCON), an innovation-led global biopharmaceuticals company, today announced its consolidated financial results for the fiscal second quarter ended September 30, 2025.

Leadership Comments

BIOCON GROUP

“Business performance in Q2 FY26 remained strong, with operating revenue up 20% year-on-year to Rs 4,296 crore, driven by robust growth in Biosimilars, improved momentum in Generics, and a steady contribution from the CRDMO segment. EBITDA grew 29% to Rs 928 crore, while Profit before Tax (PBT), excluding exceptional items, surged 153% to Rs 183 crore.

“With the Board approval of the settlement of structured debt obligations, we will strengthen our balance sheet, enhance financial flexibility, and improve profitability.

“Our partnership with the State of California through Civica Inc. under the CalRx initiative, marks a landmark step in expanding affordable insulin access in the U.S., with potential to extend to other states.

“With a resilient foundation, differentiated portfolio, and clear strategy, we are well positioned to sustain growth and deliver long-term value to our stakeholders.”

– Kiran Mazumdar-Shaw, Chairperson, Biocon Group

BIOCON GENERICS

“The Generics business continued its steady performance in Q2 with a growth of 24% driven primarily by an uptick in recently launched products in the U.S. and EU, as well as growth in the generic formulations base business, and the API business.

“A key highlight of this quarter was the inauguration of Biocon’s first OSD manufacturing facility in the United States, a significant step towards expanding access to our vertically integrated portfolio for patients in the region. We commenced filings for Semaglutide (gOzempic) in various markets, including Canada and Brazil.”

– Siddharth Mittal, CEO & Managing Director, Biocon Limited

BIOCON BIOLOGICS

“Biocon Biologics delivered a strong performance in Q2 FY26, achieving 25% year-on-year revenue growth and an over 40% increase in EBITDA. Sequentially, revenues grew 11%, driven by market share expansion in key therapy areas and successful new product launches.

In the U.S., we continue to expand access to biosimilars by leveraging the strength of our commercial platform. In FY26, we launched four biosimilars across key global markets and remain on track for the bDenosumab launch.”

– Shreehas Tambe, CEO & Managing Director, Biocon Biologics Limited

SYNGENE

“Our Q2 results reflect strong underlying revenue growth in research services, which has offset the expected inventory correction in biologics manufacturing. We continue to maintain our annual guidance for FY26.

“We are also building a GMP bioconjugation suite at our Bengaluru biologics facility, which will enable end-to-end manufacturing of Antibody Drug Conjugates (ADCs), positioning us among a select group of CRDMOs offering comprehensive ADC services.”

– Peter Bains, CEO & Managing Director, Syngene International Limited.

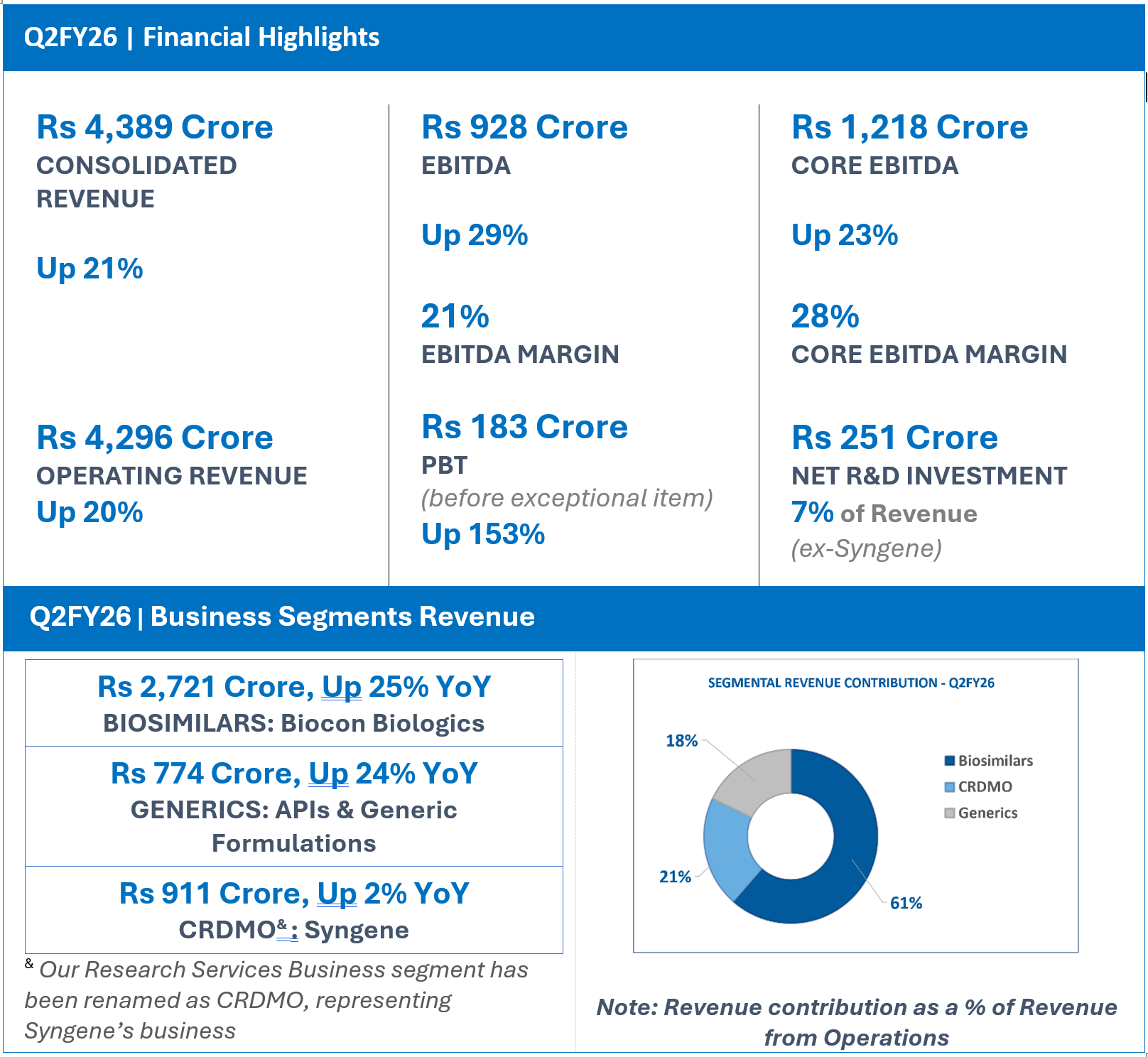

FINANCIAL HIGHLIGHTS (CONSOLIDATED): Q2FY26

In Rs Crore

| Particulars | Q2FY26 | Q2FY25 | YoY (%) |

| INCOME | |||

| Biosimilars | 2721 | 2182 | 25 |

| Generics | 774 | 624 | 24 |

| CRDMO/ Research Services | 911 | 891 | 2 |

| Inter-segment | (110) | (107) | 3 |

| Revenue from operations# | 4296 | 3590 | 20 |

| Other income | 93 | 33 | 186 |

| Total Revenue | 4389 | 3623 | 21 |

| Net R&D Expenses | 251 | 200 | 25 |

| EBITDA | 928 | 718 | 29 |

| EBITDA Margins | 21% | 20% | |

| Core EBITDA$ | 1218 | 992 | 23 |

| Core EBITDA Margins | 28% | 28% | – |

| PBT (before Exceptional Items^) | 183 | 72 | 153 |

| PBT | 171 | 98 | 74 |

| Net Profit (before Exceptional Items) | 92 | (13) | 579 |

| Net Profit (Reported) | 85 | (16) | 428 |

Figures above are rounded off to the nearest Crore; % based on absolute numbers.

Notes to financials above:

#Revenue from operations includes licensing income

$Core EBITDA is EBITDA net of R&D expense, licensing, forex, and mark-to-market movement on investments.

^Exceptional items Q2 FY26: Customer litigation settlement, Q2FY25: Inventory provision reversal gain

Financial Commentary: Q2FY26

Operating Revenue for Q2FY26 grew 20% year-on-year (YoY) to Rs 4,296 crore.

Core EBITDA at Rs 1,218 crore, grew 23% with core operating margins of 28%.

Net R&D investments for the quarter were Rs 251 crore, representing 7% of revenue ex-Syngene.

EBITDA for the quarter at Rs 928 crore, grew by 29 % with an EBITDA margin of 21%.

Profit Before Tax before exceptional items stood at Rs 183 crore, an increase of 153%.

Net Profit for the quarter, before exceptional items, stood at Rs 92 crore with a growth of 579%

Reported Net Profit for the quarter stood at Rs 85 crore, up 428%

Biocon has strengthened its balance sheet by settling its structured debt obligations with Goldman Sachs and Kotak through QIP proceeds and has also executed an agreement with Edelweiss. This will improve margins going forward and the full impact of reduced interest cost will be reflected in FY 27.

Corporate Highlights

First Manufacturing Facility in the U.S.

Biocon’s first U.S. manufacturing facility in Cranbury, New Jersey, was inaugurated in September 2025, by Governor Phil Murphy. This Oral Solid Dosage (OSD) facility with an annual production capacity of 2 billion tablets has been set up with an investment of over USD 30 million. The facility will significantly expand capacity to support the vertically integrated portfolio for patients in the region.

Awards and Recognitions

Kiran Mazumdar-Shaw, Founder & Chairperson, Biocon Group, has been ranked 2nd among India’s Most Generous Women in the EdelGive Hurun India Philanthropy List 2025.

The EdelGive Hurun India Philanthropy List 2025 also features Biocon among the Top 10 companies exceeding mandatory CSR spend.

Kiran Mazumdar-Shaw has also been listed in the Top 10# richest self -made women in global healthcare. She has been ranked at No. 3 among the women who have transformed the healthcare industry through Innovation, Leadership & Entrepreneurship impacting millions of lives worldwide.

#Source: Indian Express story based on Forbes annual list of the 50 wealthiest self-made women in the world

Biocon Among Top Global Employers

Biocon has once again made it to the list of Top 20 Global Employers in Biotech and Pharma by U.S. based Science Careers magazine. In 2025, Biocon is ranked at No. 9, and is the only organization from Asia, to feature among the leading global employers.

QCFI & CII Awards: 17

Biocon received 7 awards from the Quality Circle Forum of India (QCFI) for excellence in Production, Quality and EHS. It also won 3 awards for Operational Excellence, at the CII National Kaizen Competition.

Biocon Biologics won 7 awards for operational excellence at the CII National Kaizen Competition.

Sustainability / ESG

- Biocon scored 71 in the 2025 S&P Global Corporate Sustainability Assessment reflecting an improvement of 3 points over the last year. (CSA Score as of 31/10/2025).

- Biocon Biologics was honoured with the Golden Peacock Award for Excellence in Corporate Governance 2025, presented by the Institute of Directors, in London.

- Syngene’s EcoVadis 2025 score moved up to 74 from 66 last year, placing the company in the 91st percentile, ranking it among the top companies worldwide for sustainability practices.

- Syngene earned the highest Green Level Certification with a score exceeding 94% in a pilot sustainability assessment of its Labs, conducted by US sustainability certification expert, My Green Lab.

Business Highlights

BIOSIMILARS: Biocon Biologics

- Q2FY26 Revenue from Operations at Rs 2,721 crore, Up 25% YoY

- Q2FY26 EBITDA was Rs 669 crore; representing EBITDA Margin of 25%

- Q2FY26 R&D Investments accounted for 7% of Revenue

- Served 6.3+ Million Patients (MAT September 2025 basis)##

##12-month moving annual patient population (October 2024 to September 2025)

Business Performance

Biosimilars revenue from operations for Q2FY26 stood at Rs. 2,721 crore, reflecting a strong 25% year-on-year (YoY) growth. This translated into an EBITDA at Rs. 669 crore, up over 40%.

The Biosimilars business sustained EBITDA margin expansion for the second consecutive quarter, with Q2FY26 margins at 25%, up ~400 bps, representing improvement in operating leverage as the company continues to realize the benefits of economies of scale.

The Company secured 13 new approvals and executed 19 product launches across key markets during the quarter.

GENERICS: APIs & Generic Formulations

- Q2FY26 Revenue from Operations at Rs 774 Crore, up 24% YoY

- Q2FY26 R&D Investment was Rs 71 crore, accounting for 9% of Revenue

Business Performance

The Generics business performance in the second quarter was driven by robust traction from the recently launched generic formulations, like Liraglutide, Dasatinib, and Sacubitril + Valsartan, across key markets, along with increased sales from the base business of generic formulations and APIs.

CRDMO : Syngene

- Q2FY26 Revenue from Operations at Rs 911 Crore, Up 2% YoY

- Q2FY26 EBITDA was Rs 215 Crore, representing EBITDA Margin of 23%

Business Performance

The CRDMO (Contract Research Development & Manufacturing Organization) business reported revenues of Rs 911 crore and EBITDA of Rs 215 crore during Q2FY26.

The Company secured its first global phase III clinical trial from a U.S.-based biotech company, which will recruit patients across clinical sites in India and the U.S. During the quarter, Syngene also expanded its clinical trials footprint to Australia, New Zealand, the UK, Sri Lanka, and Eastern Europe. Bayview biologics manufacturing facility in the U.S. remains on track towards operationalization, in the second half of the year.

Note: Biocon in Q1FY26 renamed its Research Services business segment as CRDMO to represent Syngene’s business model of a CRO + CMO.

About Biocon Limited

Biocon Limited, publicly listed in 2004, (BSE code: 532523, NSE Id: BIOCON, ISIN Id: INE376G01013) is an innovation-led global biopharmaceuticals company committed to enhance affordable access to complex therapies for chronic conditions like diabetes, cancer and autoimmune. It has developed and commercialized novel biologics, biosimilars, and complex small molecule APIs in India and several key global markets as well as Generic Formulations in the U.S., Europe & key emerging markets. It also has a pipeline of promising novel assets in immunotherapy under development. Website: www.biocon.com Follow-us on X (formerly Twitter) @bioconlimited and LinkedIn: @BioconLimited for company updates. For FY25 Integrated Annual Report of Biocon click here

Biocon Biologics Limited, a subsidiary of Biocon Limited, is a unique, fully integrated, global biosimilars company committed to transforming healthcare and transforming lives. It is capitalizing on its ‘lab to market’ capabilities to serve over 6.3 million patients across 120+ countries by enabling affordable access to high quality biosimilars. The Company is leveraging cutting-edge science, innovative tech platforms, global scale manufacturing capabilities and world-class quality systems to lower costs of biological therapeutics while improving healthcare outcomes.

Biocon Biologics has commercialized 10 biosimilars from its portfolio which are addressing the patients’ needs in key emerging markets and advanced markets like U.S., Europe, Australia, Canada, and Japan. It has a pipeline of 20 biosimilar assets across diabetology, oncology, immunology, ophthalmology, bone health and other non-communicable diseases. The Company has many ‘firsts’ to its credit in the biosimilars industry. As part of its environmental, social and governance (ESG) commitment, it is advancing the health of patients, people, and the planet to achieve key UN Sustainable Development Goals (SDGs). Website: www.bioconbiologics.com; Follow us on X (formerly Twitter): @BioconBiologics and LinkedIn: Biocon Biologics for company updates.

Syngene International Ltd.

About Syngene: Syngene International Ltd. (BSE: 539268, NSE: SYNGENE, ISIN: INE 398R01022) is an integrated research, development, and manufacturing services company serving the global pharmaceutical, biotechnology, nutrition, animal health, consumer goods, and specialty chemical sectors. Syngene’s team of over 5,600 scientists brings both deep expertise and the capacity to deliver scientific excellence, robust data security, and world class manufacturing, at speed, to improve time-to-market and lower the cost of innovation. With 2.5+ mn sq. ft of specialized discovery, development, and manufacturing facilities, Syngene works with around 400 global customers across industry segments, including biotech companies pursuing leading-edge science and multinationals such as BMS, GSK, Zoetis, and Merck KGaA. For more details, visit www.syngeneintl.com . For the Company’s latest Environmental, Social, and Governance (ESG) report, visit Syngene ESG Report.

Brazil

Brazil Egypt

Egypt Europe

Europe Hong Kong

Hong Kong Malaysia

Malaysia Mexico

Mexico Morocco

Morocco Philippines

Philippines Saudi Arabia

Saudi Arabia South Africa

South Africa Taiwan

Taiwan Thailand

Thailand Tunisia

Tunisia Turkey

Turkey UAE

UAE USA

USA Vietnam

Vietnam Canada

Canada Global HQ

Global HQ