BIOSIMILARS: Biocon Biologics Limited (BBL)

-

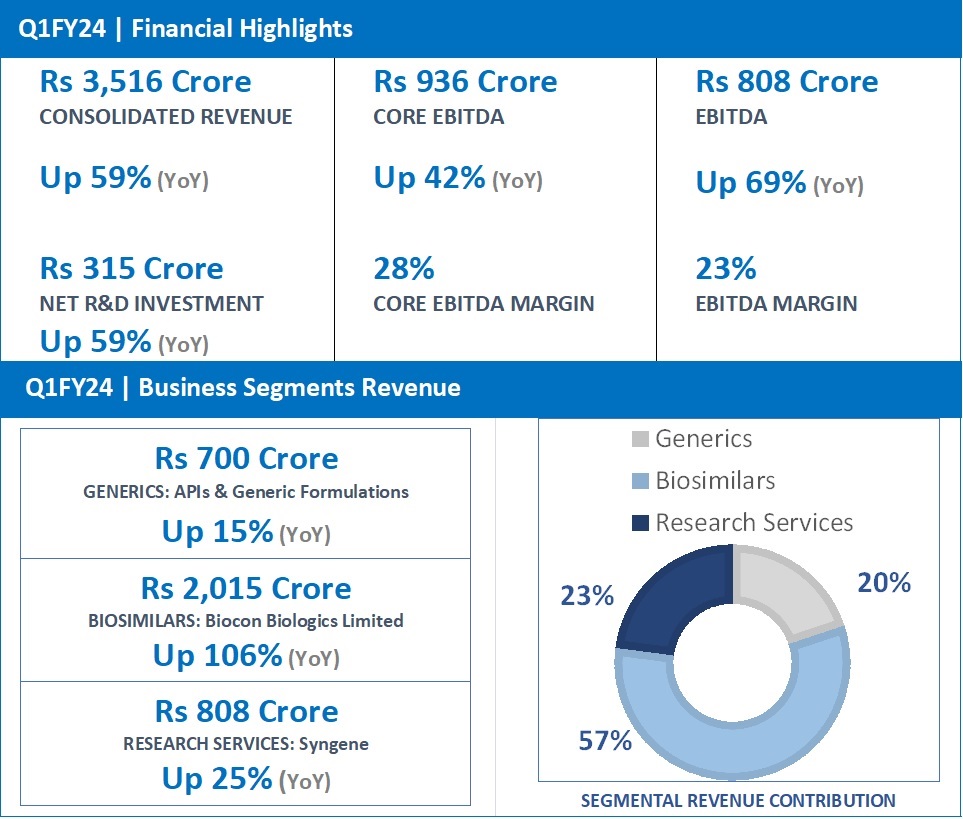

Q1FY24 Revenue at Rs 2,015 Crore, up 106% (YoY) from Rs 977 Crore in Q1FY23.

-

7 product launches and five approvals across both Advanced & Emerging Markets.

-

Served ~5.7 million patients (MAT June 2023)##

##12-month moving annual patient population (July 2022 to June 2023)

Business Performance

Biocon Biologics reported a strong YoY growth of 106% for Q1FY24 with revenues at Rs 2,015 crore, led by the strong performance of its key biosimilars in Advanced and Emerging markets and the consolidation of revenues from the acquired business. Market shares of our key brands are gaining traction reflecting an increase in demand across several markets.

Core EBITDA stood at Rs 513 crore, up 42%, reflecting margins of 28%. During the quarter, Net R&D investments stood at Rs 259 crore, representing 13% of Biocon Biologics revenue for the quarter.

EBITDA for the quarter stood at Rs 457 crore, up 141%, representing an EBITDA margin of 23%.

Profit Before Tax for the quarter stood at Rs 24 crore.

The revenues and margins for the quarter were impacted due to phasing of the tender business in Emerging Markets and higher rebates for Pegfilgrastim in the U.S., based on legacy contracts with select customers which will normalize in the coming quarters.

Advanced Markets

North America

Biocon Biologics launched its fourth biosimilar in the U.S., Hulio[1] (adalimumab-fkjp) injection, a biosimilar to Humira®[2], in July after five years of experience in Europe and two years in Canada. This launch is an important milestone for Biocon Biologics as it builds on the Company’s strong presence in oncology and diabetes and expands its patient offering in the U.S. to include a new product for immunology.

Market shares for the Company’s existing commercialized biosimilars in the U.S. are trending positively. Fulphila® (bPegfilgrastim) has become the leading biosimilar in its category with a market share of 16%. Similarly, Semglee + unbranded bGlargine together reported a market share of 12% in the U.S. and Ogivri® (bTrastuzumab) steadily improved its share to 11%. (Source: IQVIA June 2023).

The Company has unlocked new growth opportunities for its biosimilar Insulin Glargine. A large, managed care integrated network has selected our bGlargine as the exclusive long-acting insulin for its members in the U.S. effective July, while another large payor has signed up for our product as the exclusive Insulin Glargine for its formulary, effective January 2024.

Europe

In Europe, the Company’s product Yesafili® became the first biosimilar Aflibercept, to receive a positive opinion, from the European Medicines Agency’s Committee for Medicinal Products for Human Use (EMA- CHMP), recommending an approval of the product. The European Commission’s decision on the approval is expected by the end of September 2023.

The Company’s key biosimilars such as Ogivri®, Hulio®, and Fulphila® built on their strong position in key European countries. Ogivri® reported a robust 34%[1] market share in Poland and 20%[2] market share in Italy. Hulio®’s market share in Germany was 18% and 12% in France respectively. Fulphila® garnered a 13% market share in France. Abevmy® (bBevacizumab) also reported a substantial increase in market share, moving up to 5% from 1% last year (Source: IQVIA May 2023).

Biocon Biologics steadily progressed in exploring additional business opportunities in key clusters during the quarter. The Company launched its three key biosimilars, Abevmy® (bBevacizumab), Ogivri® (bTrastuzumab) and Hulio® (bAdalimumab), in four Advanced Markets.

Emerging Markets

Post completion of the acquisition in November 2022, the integration process is in full swing. Biocon Biologics has completed the transition of the acquired biosimilars business in over 70 countries in emerging markets, effective July 1, 2023, thus increasing the scale and scope of its business.

This is a key milestone for the Company as it marks the completion of the first phase of the business integration plan, completed ahead of its schedule. This will allow the Company to meaningfully expand the geographic reach of the existing biosimilars portfolio and future pipeline into growth markets where Viatris has existing sales infrastructure and local market expertise. More than 60 customers related to the acquired business have been integrated into Biocon Biologics’ emerging markets operations.

During Q1FY24, the Emerging Markets (EMs) business was driven by a steady performance of key products, rh-Insulin, Insulin Glargine, and bTrastuzumab, across many markets. The Company also launched two products in the LATAM region and received approvals for four products in five countries. Several tenders for bTrastuzumab, bBevacizumab, bPegfilgrastim and bGlargine were won in some countries in LATAM and AFMET regions. All these developments augur well for the business, going forward.

[1] Hulio is a registered trademark of Fujifilm Kyowa Kirin Biologics Co., Ltd., licensed to the Viatris Companies. Effective November 29, 2022, Viatris completed the sale of substantially all of its biosimilars portfolio (including related product trademarks) to Biocon Biologics Limited and its subsidiaries (“Biocon”) and the relevant marketing authorizations are in the process of being transferred.

[2] Reference product, a registered trademark of AbbVie Inc.

3,4 Market share in intravenous market