Business Highlights

GENERICS: APIs & Generic Formulations

Business Performance

Performance during the quarter was led by growth in the Generic Formulations business, resulting from higher statin volumes, as well as contributions from recently launched products in the U.S. The Company launched an in-licensed product, Famotidine oral suspension, used in the treatment of ulcers and gastroesophageal reflux disease (GERD), in the U.S. In line with its MoW expansion strategy, the business launched its first drug product, Mycophenolic Sodium tablets, in Israel.

A contraction in demand for some API products on account of pricing pressures, coupled with phasing of supplies due to a planned maintenance shut down, impacted the performance of the API business.

Approvals were obtained for an in-licensed product, Rivaroxaban tablets in the EU, as well as for Posaconazole tablets, Mycophenolic Acid tablets, Tacrolimus capsules and Sacubitril/Valsartan tablets in select MoW markets.

In the U.S., the Company acquired an oral solid dosage manufacturing facility of Eywa Pharma Inc. located in Cranbury, New Jersey, through its step-down, wholly owned subsidiary, Biocon Generics Inc. The acquisition will enhance Biocon’s existing manufacturing capabilities and provide impetus to the region’s growth strategy by enabling capacities for new products earlier than planned and ensuring continuity of supply. The transition of employees to Biocon is complete and the qualification process of the site for some of the Company’s products has commenced.

In October 2023, the Company signed a partnership agreement with Juno Pharmaceuticals in Canada, for the commercialization of Liraglutide, used in the treatment of Type 2 diabetes and obesity. The partnership will add momentum to Biocon’s strategic focus on geographical expansion.

Process validation was successfully completed at the greenfield immunosuppressant API facility in Visakhapatnam, with qualification activities to commence shortly. Commercial supplies from the site are expected to begin in FY25, post qualification by global regulators.

NOVEL BIOLOGICS

Biocon’s Boston-based associate Bicara Therapeutics presented recent, positive interim data from its ongoing, open-label Phase 1/1b dose expansion study of BCA101, at the European Society for Medical Oncology (ESMO) Congress evoking strong investigator interest. The Company is in an advanced stage of a Series C fund raise.

Bicara had previously announced a USD 108 million Series B financing, which is being realized in a staggered manner. As a result, during the quarter, a step-up gain of Rs 75 crore was recorded in the consolidated P&L statement.

BIOSIMILARS: Biocon Biologics Limited (BBL) –

-

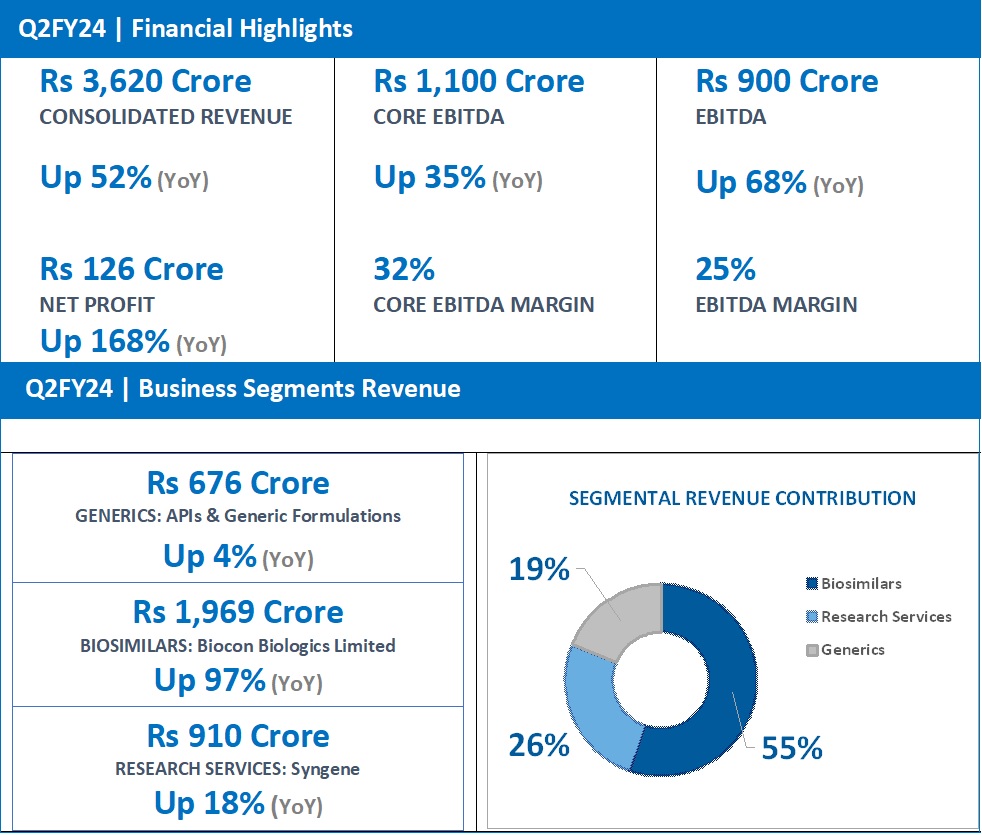

Q2FY24 Revenue at Rs 1,969 Crore, up 97% (YoY) from Rs 997 Crore in Q2FY23.

-

4 launches and 11 approvals in Emerging Markets.

-

Served ~5.5 million patients (MAT September 2023) ##

##12-month moving annual patient population (October 2022 to September 2023)

Business Performance

Biocon Biologics reported a YoY growth of 97% for Q2FY24 with revenues at Rs 1,969 crore, driven by the consolidation of the acquired business and sustained growth from the core business across Advanced and Emerging Markets.

Core EBITDA at Rs 660 crore, grew by 47%, reflecting healthy margins of 34%. During the quarter, Net R&D investments stood at Rs 211 crore, representing 11% of Biocon Biologics’ revenue for the quarter, a reflection of the continued progression of its pipeline assets.

EBITDA for the quarter reported a growth of 112 % at Rs 453 crore, representing an EBITDA margin of 23%.

Advanced Markets

North America

In-market products continue to perform well with double-digit market shares, reflecting customer and key stakeholder confidence. Fulphila® (bPegfilgrastim) has consolidated its position as a leading biosimilar in its category with its share in the U.S. market growing to ~19%. Unbranded bGlargine along with Semglee® and Ogivri® (bTrastuzumab) held steady market shares at ~12% and 11%, respectively. For Adalimumab, the adoption of biosimilars has been slower than anticipated across the market, which has softened adoption of our brand Hulio® as well.

The Company has focused on expanding market access to drive adoption of Hulio®, a biosimilar to HUMIRA®(Adalimumab). It continues to engage customers to add Hulio®/Adalimumab-fkjp Injection to their formularies across all channels. CVS Caremark has added Biocon Biologics’ unbranded Adalimumab-fkjp Injection, as a formulary option for a select number of its formularies, effective October 1, 2023. Similarly, one of the largest Medicaid managed care organizations in the U.S. has added unbranded Adalimumab-fkjp Injection to its National Preferred Formulary for Medicaid members covering seven million lives. A large U.S. payor covering 100 million lives has added Ogivri® and Fulphila® to their 2024 preferred medical drug list.

Europe

In Europe, Abevmy® (bBevacizumab) reported a significant increase in market share over the last two quarters to 6%, while Fulphila® saw a steady uptick in its market share to 7%. Hulio® maintained a steady market share of 6% overall in Europe with shares of 18% in Germany and 11% in France. Fulphila® improved its market share to ~14% in France. (Source: IQVIA Q2 CY 2023). The Company also launched bAspart in Germany.

Biocon Biologics received the European Commission’s approval for YESAFILI®, a biosimilar Aflibercept that could make a meaningful difference to patients in the EU impacted by macular degeneration and diabetic retinopathy. The EU brand sales of Aflibercept stood at ~USD1.8 billion (MAT December 2022 IQVIA).

Emerging Markets

The business in Emerging Markets continued to see a steady performance with growth being largely driven by bGlargine and bTrastuzumab in LATAM and APAC regions. There were four product launches and 11 approvals of key products in Emerging Markets, which augur well for the future.

Biocon Biologics has divested two non-core business units, Dermatology and Nephrology, of its Branded Formulations India (BFI) business through a ‘slump sale’ to Eris Lifesciences for a total transaction value of Rs 366 crore inclusive of working capital adjustment. This value accretive deal allows the Company to unlock value from the BFI business and sharpen focus on its core therapy areas like Diabetes, Oncology and Immunology.

Integration of Viatris Business

The transition of the acquired biosimilars business in North America was successfully completed ahead of schedule in September 2023 and Biocon Biologics is now leading the commercial operations in the U.S. and Canada. The business transition plans in Europe, JANZ (Japan, Australia and New Zealand and the remaining few Emerging Markets are on track for completion later during the year, which will complete the integration of the acquired business.

RESEARCH SERVICES: Syngene

Business Performance

In Q2FY24, the Research Services business delivered positive performances across all divisions led by Development and Manufacturing Services, while the Dedicated Centers business showed sustained growth. The Manufacturing Services vertical reported good progress on the back of their biologics manufacturing agreement with Zoetis.

Syngene continued to invest in capacity building and commissioned a state-of-the-art, digitally enabled Quality Control laboratory to support the growing biologics operations. It also commissioned a non-GMP facility in Bengaluru to add to its capability of doing early-phase development projects in an agile and cost-effective manner.