EBITDA at Rs 723 Cr, Up 35%; Core EBITDA at Rs 1,069 Cr, Up 49%; Net Profit (excluding exceptional items) at Rs 140 Cr

Bengaluru, Karnataka, India: February 14, 2023:

Biocon Ltd (BSE code: 532523, NSE: BIOCON), an innovation-led global biopharmaceuticals company, today announced its consolidated financial results for the third quarter ended December 31, 2022.

Leadership Comments

BIOCON GROUP

“Q3 FY23 has been an eventful quarter which saw the completion of the global acquisition of our partnered Biosimilars business from Viatris on Nov 29, 2022. We are now implementing country-wise integration of the business to maximize the value of the combined entity to propel growth. Biosimilars as a business segment offers differentiated growth to Biocon Biologics based on vertical integration and a unique portfolio of Insulins and antibody based immunotherapeutics. This quarter captures a fraction of the acquired business, but from Q4FY23 onwards, the financials will recognise the entire Biosimilars business.

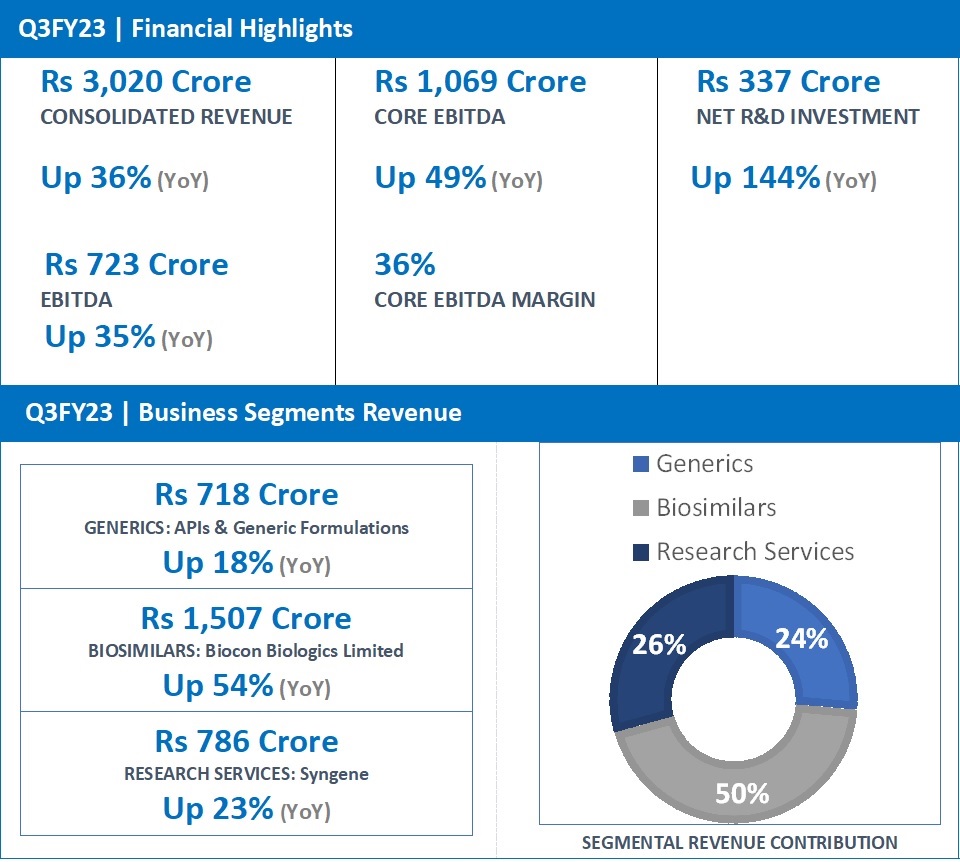

“Biocon’s consolidated revenues for the quarter grew 36% to Rs 3,020 crore on the back of robust performance across all its three businesses. The biggest contribution came from the Biosimilars business, which reported a 54% increase in revenues to Rs 1,507 crore. Research Services revenues at Rs 786 crore and Generics business revenues at Rs 718 crore, grew 23% and 18%, respectively. The advancement of our research pipeline led to Rs 337 crore Net R&D investments this quarter, which will drive Biocon’s future growth. We reported a strong EBITDA growth of 35% to Rs 723 crore, representing a healthy EBITDA margin of 24%. Core EBITDA grew 49% to Rs 1,069 crore. As a part of our strategy to reduce the acquisition debt, Biocon has raised funds through a partial divestment of its stake in Syngene.

“We expect to end FY23 on a strong note with healthy growth across businesses. Biocon Biologics is tracking towards exiting the year at a USD 1 billion trajectory, excluding vaccines.” — Kiran Mazumdar-Shaw, Executive Chairperson, Biocon and Biocon Biologics.

BIOCON BIOLOGICS

“Biocon Biologics recorded its highest ever quarterly revenue of Rs 1,507 crore, reflecting a growth of 54% on the back of our acquisition of Viatris’ biosimilars business and continued growth in BBL led markets. This strong performance has translated to an EBITDA growth of 53% to Rs 361 crore. This landmark acquisition marks an inflection point in our transformational journey and positions Biocon Biologics as a unique, fully integrated, leading global biosimilars enterprise.

“While our biosimilars portfolio continues to gain market share in the U.S. and EU, our business in the Emerging Markets is also on a growth trajectory with product launches in 8 new markets this quarter.

“We have drawn up a comprehensive plan to integrate the acquired Viatris business into Biocon Biologics and migration of business operations is scheduled in a phased manner to ensure business continuity and uninterrupted service to customers and patients.” — Shreehas Tambe, CEO & Managing Director, Biocon Biologics Ltd.

BIOCON GENERICS

“The Generics business’ third-quarter results were in line with our expectations, delivering healthy sequential and year-on-year revenue growth. The performance was driven by immunosuppressant API sales and Generic Formulations, which saw an uptick in the sales of statins as well as recent product launches. Margins, compared to the previous year, were muted by the product mix and continuing pricing pressure in the U.S. market.

“Our geographical expansion continued to gain traction with the signing of a partnership agreement with Zentiva for commercializing Liraglutide in Europe, as well as a long-term strategic partnership with Farmanguinhos in Brazil for the supply and tech-transfer of a finished dose formulation immunosuppressant product. These partnerships will contribute towards attaining mid-teens growth in the short to medium term. We also secured approvals for some of our key formulation products in Europe.

“Our focus remains on geographical expansion, new product launches, strengthening our product pipeline and executing on key capex projects.” — Siddharth Mittal, CEO & Managing Director, Biocon Limited.

SYNGENE

“We continue to see good demand in the main client markets of U.S. and Europe which – combined with strong execution and forward planning – has helped us deliver solid revenue growth in the third quarter. We are pleased to report positive performances from all divisions this quarter. Growth in our research divisions, Discovery Services and the Dedicated Centres, was solid. In Development Services, repeat orders from existing clients, as well as an increase in the number of collaborations with emerging biopharma companies drove a robust performance. In Manufacturing, the highlight of the quarter was the successful inspection of our biologics facilities by the U.S. FDA, EMA and MHRA. Based on our strong performance to date, we are confident of meeting the upgraded annual revenue growth guidance of high teens.” —Jonathan Hunt, CEO & Managing Director, Syngene.

FINANCIAL HIGHLIGHTS (CONSOLIDATED): Q3FY23

In Rs Crore

| Particulars | Q3FY23 | Q3FY22 | YoY (%) |

| INCOME | |||

| Generics | 718 | 607 | 18 |

| Biosimilars | 1,507 | 981 | 54 |

| Novel Biologics | – | 16 | (100) |

| Research services | 786 | 641 | 23 |

| Inter-segment | (69) | (72) | (3) |

| Revenue from operations # | 2,941 | 2,174 | 35 |

| Other income | 79 | 48 | 63 |

| Total Revenue | 3,020 | 2,223 | 36 |

| Net R&D Expenses | 337 | 138 | 144 |

| Gross R&D Spend | 365 | 178 | 106 |

| EBITDA | 723 | 537 | 35 |

| EBITDA Margins | 24% | 24% | |

| Core EBITDA* | 1,069 | 715 | 49 |

| Core EBITDA Margins* | 36% | 33% | |

| PBT (before Exceptional Items^) | 246 | 269 | (9) |

| Net Profit (before Exceptional Items^^) | 140 | 187 | (25) |

| Net Profit Margins (before Exceptional Items^) | 5% | 8% |

Figures above are rounded off to the nearest Crore; % based on absolute numbers. #Includes Licensing income.

*Core EBITDA is EBITDA net of R&D expense, licensing, forex, dilution gain in Bicara, mark-to-market movement on investments.

Notes to financials above:

Q3FY23 includes a forex loss of Rs 44 crore Vs a gain of Rs 19 crore in Q3FY22.

^ Exceptional items during Q3 FY23 amount to Rs 271 crore, primarily pertaining to deal related expenses of the Viatris transaction

^^Net of tax and minority interest, exceptional items amount to Rs 182 crores, resulting in the Net Loss for Q3FY23 at Rs 42 crore

Financial Commentary

Consolidated Revenues for Q3FY23 increased 36% year-on-year (YoY) to Rs 3,020 crore.

Core EBITDA (excluding R&D expense, licensing income, forex, dilution gain in Bicara and mark-to-market movement on investments) grew 49% to Rs 1,069 crore, representing healthy core operating margins of 36% versus 33% in the same quarter last year.

Net R&D investments for the quarter grew by 144% to Rs 337 crore, representing 16% of revenues ex-Syngene. This demonstrates Biocon’s advancing pipeline that will drive its future growth.

Profit Before Tax and Exceptional Items stood at Rs 246 crore compared to Rs 269 crore during the same quarter last fiscal. This decline is due to higher interest and amortisation costs resulting from the Viatris deal.

Net Profit for the quarter, excluding exceptional items, stood at Rs 140 crore versus Rs 187 crore in Q3FY22. The profit was also impacted due to dilution of Biocon’s stake in Biocon Biologics and Syngene.

Biocon To Pare Debt Related to Viatris Deal

Biocon Ltd had raised USD 420 million of mezzanine financing to part finance the USD 650 million equity infusion into Biocon Biologics. Biocon Limited has entered into a definitive agreement with Kotak Strategic Situations Fund for a structured funding upto Rs 1200 crore. This funding together with recently concluded stake sale in Syngene will help reduce net debt.

Board Updates

Shreehas Tambe has joined the Board of Directors of Biocon Biologics Ltd as CEO & Managing Director with effect from December 5, 2022. He took over this responsibility from the outgoing Managing Director of BBL, Dr Arun Chandavarkar, who will continue to serve as a non-Executive, non-Independent Director on the Board of Biocon Biologics. Shreehas Tambe has been with Biocon since 1997 and has held diverse leadership and operational roles. As Deputy CEO of Biocon Biologics since March 2021, he played an important role in building a strong foundation for the company. As CEO and MD, he will lead the company in the next phase of its transformational journey.

Rajiv Malik, President & Director of Viatris, has joined the Board of Biocon Biologics Ltd as Non-Executive, Non-Independent and Nominee Director of Viatris Inc. Rajiv Malik is a well-regarded business leader with over 40 years of experience in the global pharma industry. He has led Viatris’ global commercial, scientific, technical, business and manufacturing operations for 16 years. Rajiv Malik has played a key role in the successful decade-long collaboration of Biocon and Mylan.

Environment, Social & Governance

- Biocon has committed to the United Nations Global Compact (UNGC), the world’s largest corporate sustainability initiative, indicating its support to critical sustainability areas of environment, human rights, labour and anti-corruption.

- Biocon was awarded the Golden Peacock Sustainability Award 2022 in the ‘Pharmaceutical’ sector for its robust strategy and performance related to sustainability.

- Biocon (including Biocon Biologics) has been included in the S&P Global Sustainability Yearbook 2023, which ranks the world’s leading companies based on their sustainable business practices.

- Biocon has been recognized in the S&P Global Sustainability Yearbook 2023 as an ‘industry mover’, making it the only company from the global biotech industry in the category.

- Biocon Foundation received the India Health and Wellness (IHW) Council’s Gold Award for its ‘Oral Cancer Screening Program’ in ‘Diseases Screening Initiative of the Year’ category.

Business Highlights

BIOSIMILARS: Biocon Biologics Limited (BBL)

- Q3FY23 revenue at Rs 1,507 Crore, up 54% (YoY) from Rs 981 Crore in Q3FY22.

- Served ~5.4 million patients (MAT Dec 2022 basis)##

##12-month moving annual patient population (Jan’22 to Dec’22)

Business Performance

Biocon Biologics reported a robust growth of 54% for Q3FY23 with revenues at Rs 1,507 crore, led by a strong performance across global markets and the consolidation of Viatris’ biosimilars business, post deal close.

Effective from the date of closing of the deal on November 29, 2022, Biocon Biologics now recognizes the full value of revenue and associated profits of the acquired business, a step-up from the earlier arrangement. This quarter includes about a month’s contribution from the acquired global biosimilars business of Viatris.

During the quarter, BBL continued to make steady progress on its biosimilars pipeline which led to an increase in its R&D investments to Rs 280 crore.

EBITDA for the quarter reported a strong growth of 53% to Rs 361 crore, representing healthy EBITDA margins of 24%.

Core EBITDA at Rs 663 Crore reflects a growth of 83%. Core EBITDA margins improved to 44% from 38 % last year.

The Viatris transaction led to an increase of Rs 95 crore in depreciation, amortization and interest expense in the quarter.

Profit Before Tax and Exceptional Items for the quarter stood at Rs 102 Crore.

Advanced Markets

In Q3FY23, BBL continued to see an increase in market shares of its key commercialized biosimilars in the Advanced Markets with Fulphila (bPegfilgrastim), Ogivri (bTrastuzumab) and Semglee (bGlargine), all crossing 10% mark in the U.S. (Source: IQVIA, Dec’22) There was also a strong uptake in Europe with Ogivri garnering market shares of 17% in France and 20% in Italy. Similarly, Hulio (bAdalimumab) achieved market shares of 18% in Germany and 10% in France. The quarter witnessed the launches of bBevacizumab in Australia, and bGlargine & bAspart in Canada.

Emerging Markets

During the quarter, the Emerging Markets business delivered a strong performance that was driven by BBL’s insulins and monoclonal antibodies portfolio. The company expanded global reach through eight new launches across several key markets. In India, Basalog (bGlargine) expanded its market share to over 13% in Q3FY23 and sales of Oncology products doubled, driven by CANMAb (bTrastuzumab), BIOMAb (Nimotuzamab) and KRABEVA (bBevacizumab).

Recent tender wins for rh-Insulin and bTrastuzumab in LATAM, AFMET, & CIS regions and regulatory approvals for bGlargine and bBevacizumab will help drive growth in the Emerging Markets business, going forward.

Biosimilars Pipeline Development

BBL’s pipeline assets continued to progress as per plan in Q3FY23. Patient recruitment was completed for Phase I and Phase III, global clinical trials for bDenosumab and bUstekinumab. bPertuzumab, an oncology product, entered Phase I global clinical trials. Regulatory applications for bAflibercept were filed in several global markets, including the EU, UK and Japan. An interchangeability study was initiated for bAdalimumab, which is expected to enable BBL to maximize the commercial value of Hulio (bAdalimumab), in U.S.

Integration of Viatris’ Global Biosimilars Business

Biocon Biologics successfully completed the multi-billion-dollar (USD) acquisition of the global biosimilars business of its partner Viatris on November 29, 2022. BBL made an upfront payment of USD 3 billion in part cash, part stock to Viatris to complete the acquisition. The cash component was funded through debt raised by BBL, as well as equity infusions by Biocon Ltd and Serum. Incremental revenues and profits post deal closure are reflected in BBL’s earnings this quarter.

BBL is in discussions with private equity investors for an additional fund raise to pare down its debt.

The company has also drawn up a comprehensive global integration plan and intends to start migrating country-wise business operations in a phased manner.

Viatris continues to provide commercial and other transition services to Biocon Biologics as part of a pre-agreed Transition Services Agreement intended to ensure seamless business continuity and allow for a gradual integration of people and business activities.

NOVEL BIOLOGICS

Itolizumab

Patient enrolment has been ramped up and all 45 clinical study sites for the pivotal Phase III clinical study of Itolizumab in patients with acute graft-versus-host disease (aGVHD) are fully operational.

Enrolment also continues for the Phase 1b clinical study for Lupus Nephritis and topline data is expected to be announced later this year. Patient dosing (randomization) has commenced for the Phase II clinical trial underway in India for patients with Ulcerative Colitis.

GENERICS: APIs & Generic Formulations

- Q3FY23 revenue at Rs 718 Crore, up 18% (YoY) from Rs 607 Crore in Q3FY22.

Business Performance

During the quarter, Biocon obtained approvals for Fingolimod capsules and Lenalidomide capsules, an in-licensed product in the U.K.; Prazosin capsules, an in-licensed product in the U.S., as well as Mycophenolic acid tablets and Tacrolimus tablets in MoW markets.

In November 2022, the company signed a semi-exclusive agreement with Zentiva, a leading European pharmaceutical company. Under the terms of this agreement Biocon will manufacture and supply Liraglutide to Zentiva for its commercialization in 30 countries across Europe. Liraglutide is a vertically integrated, complex formulation, drug-device combination used in the treatment and management of Type 2 diabetes and obesity.

Biocon entered into a long-term strategic partnership with Farmanguinhos in Brazil for the supply and tech-transfer of an immunosuppressant finished dosage formulation (FDF) product.

The European Directorate for the Quality of Medicines & HealthCare (EDQM) issued a Good Manufacturing Practice (GMP) Certificate of Compliance for the Active Pharmaceutical Ingredient (API) manufacturing facility in Bengaluru following a GMP inspection of the site conducted in September 2022.

Progress continues to be made on Biocon’s greenfield immunosuppressant API facility in Visakhapatnam and peptide facility in Bengaluru with the commencement of validation batches at both the sites, which are expected to be completed by H1FY24.

RESEARCH SERVICES: Syngene

- Q3FY23 revenue at Rs 786 Crore, up 23% (YoY) from Rs 641 Crore in Q3FY22.

Business Performance

Syngene’s Q3FY23 results reflect positive performances across all divisions. Its research divisions, Discovery Services and the Dedicated Centres, delivered solid results. Development Services benefitted from repeat orders from existing clients and a growing number of collaborations with emerging biopharma companies.

Syngene’s state-of-the-art, sterile fill-finish facility has been successfully inspected by the Central Drugs Standard Control Organization (CDSCO), India, enabling its commissioning in Q4FY23. This will expand company’s capability to offer end-to-end solutions in drug product development and manufacturing of clinical supplies of small and large molecule injectables.

Enclosed: Fact Sheet – with Financials as per IND-AS

About Biocon Limited:

Biocon Limited, publicly listed in 2004, (BSE code: 532523, NSE Id: BIOCON, ISIN Id: INE376G01013) is an innovation-led global biopharmaceuticals company committed to enhance affordable access to complex therapies for chronic conditions like diabetes, cancer and autoimmune. It has developed and commercialized novel biologics, biosimilars, and complex small molecule APIs in India and several key global markets as well as Generic Formulations in the US and Europe. It also has a pipeline of promising novel assets in immunotherapy under development. Website: www.biocon.com; Follow-us on Twitter: @bioconlimited for company updates.

Biocon Biologics Ltd. (BBL), a subsidiary of Biocon Ltd., is a unique, fully integrated, global biosimilars company committed to transforming healthcare and transforming lives by enabling affordable access to affordable biologics for millions of patients worldwide. It is leveraging cutting-edge science, innovative tech platforms, global scale manufacturing capabilities and world class quality systems to lower costs of biological therapeutics while improving healthcare outcomes. BBL has acquired the global biosimilars business of its long-standing partner Viatris, which is a historic milestone in its value creation journey. Biocon Biologics has commercialized eight biosimilars in key emerging markets and advanced markets like U.S., EU, Australia, Canada, Japan.

The Company has a pipeline of 20 biosimilar assets across diabetology, oncology, immunology, and other non-communicable diseases. It has many ‘firsts’ to its credit in the biosimilars industry. It has also signed a strategic alliance with Serum Institute Life Sciences for vaccines (subject to certain closing conditions) to address the inequitable access to lifesaving vaccines. As part of its environmental, social and governance (ESG) commitment, BBL is advancing the health of patients, people and the planet to achieve key UN Sustainable Development Goals (SDGs). Website: www.bioconbiologics.com; Follow us on Twitter: @BioconBiologics for company updates.

Forward-Looking Statements: Biocon

This press release may include statements of future expectations and other forward-looking statements based on management’s current expectations and beliefs concerning future developments and their potential effects upon Biocon and its subsidiaries/ associates. These forward-looking statements involve known or unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Important factors that could cause actual results to differ materially from our expectations include, amongst other: general economic and business conditions in India and overseas, our ability to successfully implement our strategy, our research and development efforts, our growth and expansion plans and technological changes, changes in the value of the Rupee and other currency changes, changes in the Indian and international interest rates, change in laws and regulations that apply to the Indian and global biotechnology and pharmaceuticals industries, increasing competition in and the conditions of the Indian and global biotechnology and pharmaceuticals industries, changes in political conditions in India and changes in the foreign exchange control regulations in India. Neither Biocon, nor our Directors, or any of our subsidiaries/associates assume any obligation to update any particular forward-looking statement contained in this release.