Business Highlights

GENERICS: APIs & Generic Formulations

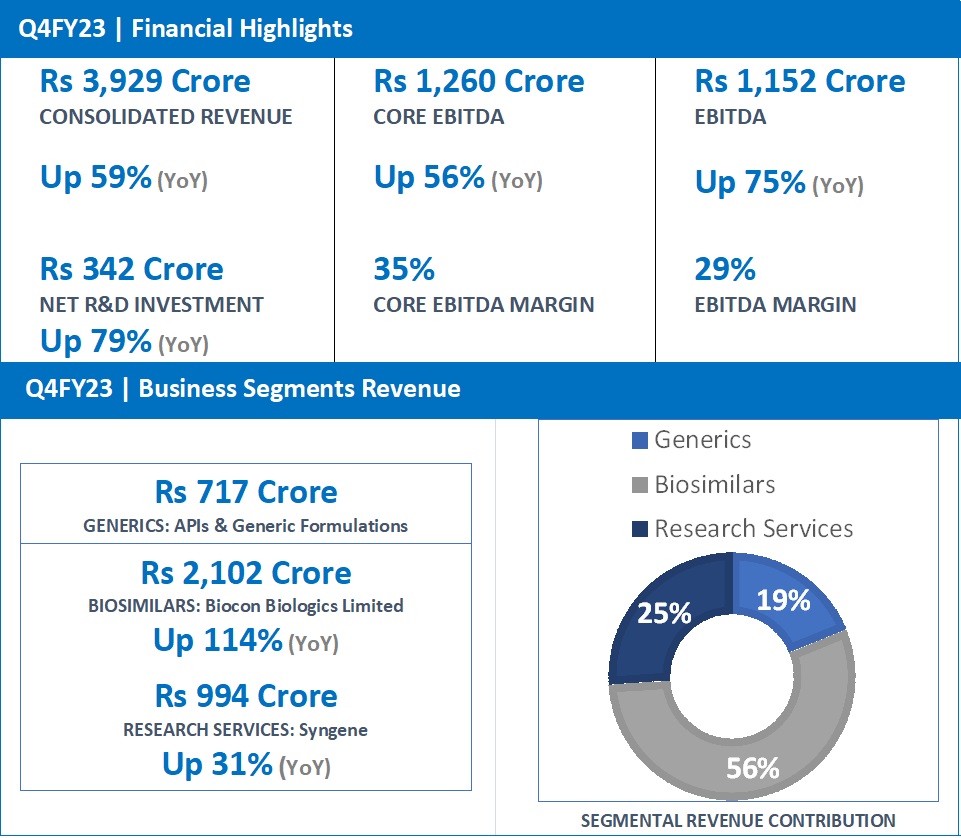

- Q4FY23 revenue at Rs 717 Crore, same as in Q4FY22.

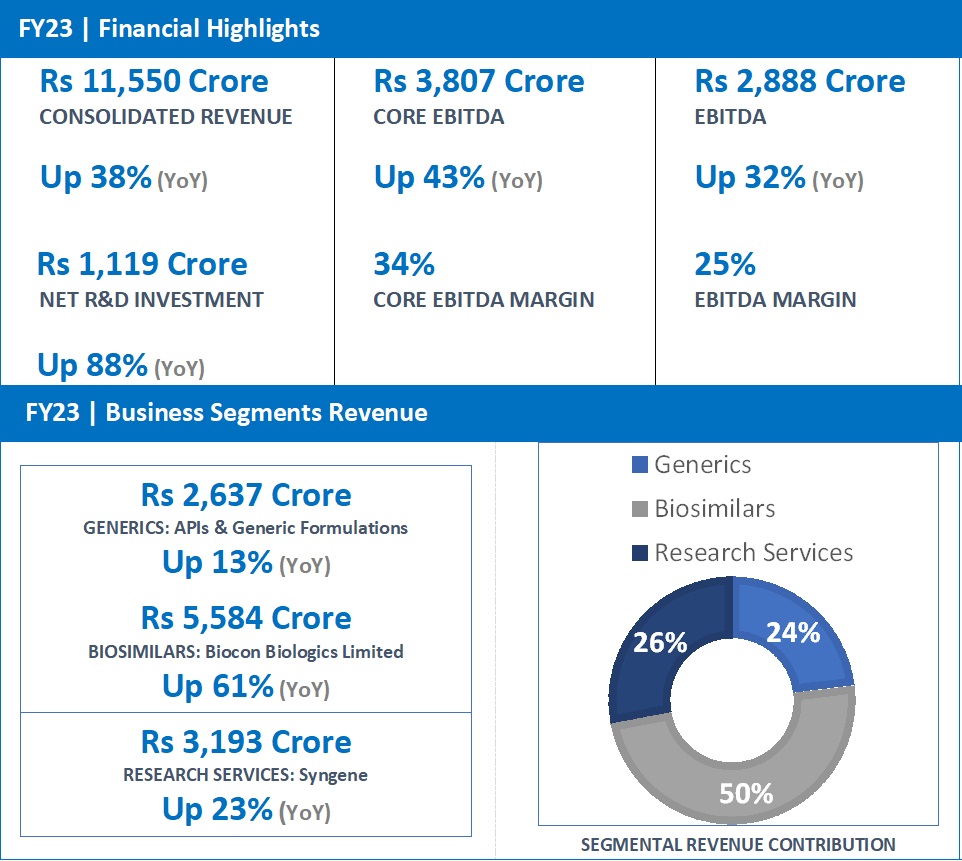

- FY23 Revenue at Rs 2,637 Crore, up 13% from Rs 2,341 Crore in FY22.

Business Performance

Revenue growth for Q4FY23, on a YoY basis, was muted, mainly due to the product mix. During the quarter, important contracts for some key products were secured in the U.S. The Company won a new tender in Netherlands and secured its first set of tenders in the UK and Ukraine.

During the quarter, the Company obtained four product approvals across geographies. In the U.S., Biocon received approval for Teriflunomide tablet, an anti-inflammatory and immunomodulatory drug used in the treatment of relapsing forms of multiple sclerosis. In the EU, approval was received for Dimethyl Fumarate, an in-licensed product. Approvals were also obtained for Oncology products, Everolimus tablets in Saudi Arabia and Dasatinib tablets in Chile.

The Company also received a tentative approval from the U.S. FDA for Lenalidomide in May 2023, which is used in the treatment of adults with multiple myeloma (MM).

The API manufacturing site at Bengaluru underwent an EU GMP inspection in February 2023 with no critical or major observations. In May 2023, the U.S. FDA concluded a pre-approval inspection at the API facility in Hyderabad with zero observations.

BIOSIMILARS: Biocon Biologics Limited (BBL)

- Q4FY23 revenue at Rs 2,102 Crore, up 114% (YoY) from Rs 982 Crore in Q4FY22.

- FY23 revenue at Rs 5,584 Crore, up 61% from Rs 3,464 Crore in FY22.

- 35+ launches of BBL’s eight commercialized biosimilars in markets worldwide in FY23.

- Served ~5.7 million patients (MAT March 2023 basis)##

##12-month moving annual patient population (April 2022 to March 2023)

Business Performance

FY23

Biocon Biologics’ revenue for the full year stood at Rs 5,584 Crore, reporting a growth of 61%. EBITDA for the year stood at Rs 1,338 crore, a year-on-year growth of 32%. Core EBITDA grew by 68% to Rs 2,216 crore.

Net R&D investments for the year increased 186% to Rs 889 crore, representing 16% of revenue, reflecting the progress of our pipeline assets in global clinical trials.

Q4FY23

Biocon Biologics reported a YoY growth of 114% for Q4FY23 with revenues at Rs 2,102 crore, led by a strong performance across global markets and the consolidation of the acquired biosimilars business. Q4FY23 is the first quarter reflecting the full financial impact of the consolidated business.

Core EBITDA at Rs 742 crore reflects a YoY growth of 95%. Core EBITDA margins stood at 39% same as in Q4FY22. During the quarter, Net R&D investments stood at Rs 295 crore.

EBITDA for the quarter increased 123% to Rs 573 crore, representing healthy EBITDA margins of 27%. Profit Before Tax and Exceptional Items for the quarter stood at Rs 152 crore.

Advanced Markets

In Q4FY23, Biocon Biologics business in Advanced Markets reported a strong growth reflecting an increase in market shares of its commercialized products. In the U.S, Semglee (bGlargine) reported a market share of ~12%, Fulphila’s (bPegfilgrastim) share was at 14%, while Ogivri (bTrastuzumab) continued to hold its position with 10% market share, in March 2023. In Europe, Hulio (bAdalimumab) is maintaining its market share at 18.5% in Germany and 10% in France. In addition, the Company continues to evaluate expansion in European countries as it transitions the Viatris business.

Emerging Markets

The Company expanded global reach through 8 new product launches in the AFMET, LATAM and APAC regions, which augurs well for the future. Q4FY23 also saw the launch of bAspart in Malaysia and bAdalimumab in two new countries.

New tenders for bTrastuzumab, bGlargine and bPegfilgrastim won this quarter in the AFMET and LATAM regions will contribute to the Emerging Markets growth in FY24.

Global Clinical Development

The global clinical development of three of its pipeline assets, bDenosumab, bUstekinumab and bPertuzumab, is progressing as per plan.

Multi-Product Antibodies Manufacturing Facility Receives EU GMP Certification

In April, Biocon Biologics’ integrated, multi-product, monoclonal antibodies (mAbs) Drug Substance manufacturing facility (B3) at Biocon Park, Bengaluru, received a Certificate of GMP Compliance for an additional product, bBevacizumab, from the representative European inspection authority, Health Products Regulatory Authority (HPRA), Ireland unlocking additional capacity to meet the needs of patients in the EU.

Integration of Viatris’ Global Biosimilars Business

Post closure of the acquisition, Viatris continues to provide commercial and other transition services to Biocon Biologics as per the Transition Services Agreement. The integration of the acquired business is on track, as we transition the business region-wise in a phased manner during FY24.

NOVEL BIOLOGICS

Itolizumab

The novel molecule, Itolizumab, continues to make progress with our U.S.-based partner Equillium, ramping up patient enrolment. For the ongoing pivotal Phase 3 study in aGVHD, the Company has over 70 sites operationalized. The Phase 1B clinical study for Lupus Nephritis also remains on track with top-line data expected in the first half of 2024.

BICARA

Biocon’s Boston-based associate Bicara Therapeutics has raised USD 108 million in Series B financing to support future studies of its lead program BCA101, which is currently in Phase 1/1b clinical development in head and neck cancer.

RESEARCH SERVICES: Syngene

- Q4FY23 revenue at Rs 994 Crore, up 31% (YoY) from Rs 758 Crore in Q4FY22.

- FY23 revenue at Rs 3,193 Crore, up 23% from Rs 2,604 Crore in FY22.

Business Performance

Syngene ended the financial year on a strong note, with all its divisions contributing to growth in the fourth quarter. Discovery Services and Dedicated Centers businesses showed sustained growth. Syngene’s research facility in Hyderabad continued to expand and played an important role in Discovery Services. This facility now accommodates around 900 scientists. Growth in Development Services was driven predominantly by further orders from existing clients, reflecting the high service levels and sustained on-time delivery that have become the hallmark of these services. Manufacturing Services continued to support the long-term partnership with Zoetis, following the successful regulatory inspections by the U.S., European and UK regulatory authorities.

Enclosed: Fact Sheet – with Financials as per IND-AS